Contents

What is the FCA's consumer duty?

When does the FCA’s Consumer Duty come into force?

The first part of the Financial Conduct Authority’s (FCA) new Consumer Duty legislation came into force on 31 July 2023. All regulated financial sector firms – insurers, lenders, banks, DCAs and more – now have to abide by its rules.

What is the FCA’s Consumer Duty?

So what is the Consumer Duty and what are its rules? In short, the Duty aims to enhance consumer protection as people buy and use financial products.

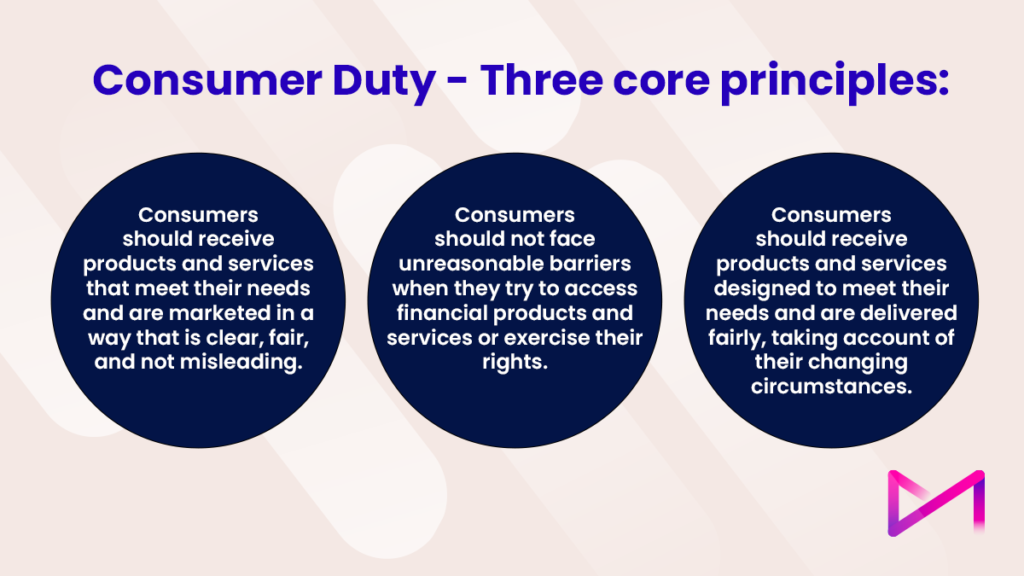

The new regulations are based on three core principles:

- Consumers should receive products and services that meet their needs and are marketed in a way that is clear, fair, and not misleading.

- Consumers should not face unreasonable barriers when they try to access financial products and services or exercise their rights.

- Consumers should receive products and services that are designed to meet their needs throughout their lifetime and are delivered fairly, taking account of their changing circumstances.

The FCA has also laid out three rules which underpin these principles. Financial services companies should:

- Act in good faith

- Avoid causing foreseeable harm

- Enable and support retail customers to achieve their financial objectives

In a recent speech, Sheldon Mills, Executive Director for Consumers and Competition at the FCA, said: “The common thread, the thing we are interested in above all else in our work, is reducing harm to consumers and ensuring firms deliver good outcomes for consumers.”

When does the FCA’s Consumer Duty come into force?

The new rules are being implemented in two stages. The rules coming into force at the end of July 2023 are for new and existing products or services that are open to sale or renewal.

For closed products or services, the rules come into force a year later, on 31 July 2024.

How will Consumer Duty impact your contact centre teams?

As the first point of contact with customers, it’s essential that contact centre teams are aware of the new rules and what they mean.

Contact centre leaders have to make sure teams are providing a high level of support, and are interacting with consumers in a way that promotes fair treatment, positive customer outcomes and increased transparency.

But what does that mean in practice? Here’s a more detailed breakdown of what the new legislation means for contact centre teams in the financial services sector.

Products and services

New and existing products will have to meet the goals of transparency and good outcomes for consumers.

The FCA has made it clear that the new Duty is not one-size-fits-all. Companies must use the principles to make changes as they see fit.

In terms of products and services, that could mean analysing product portfolios and prioritising improvements for those items with the greatest risk of consumer harm.

It may mean putting new data gathering or governance policies into place to ensure all products and services meet higher standards.

These are not roles for the contact centre, but contact centres will be in the position of having to explain any changes to consumers, and to make sure consumers understand the products and services they are buying. Clear communication is key to Consumer Duty compliance.

Price and value

Are products and services delivering value? This calculation certainly involves price but can also include non-price value. For example, does the product or service deliver on its promises, and what is the outcome for consumers?

To meet the principles of the Duty some firms are implementing full value chain analysis, while others are working to make sure consumers face no hidden costs or unexpected charges.

Effectively, companies in the sector need to ensure that there is a “reasonable relationship” between costs and benefits to meet Duty requirements. Pricing structures may need to change. The idea of “fair value” needs to be applied to all consumer groups, including vulnerable or protected customers.

Again, the contact centre has a key role to play, in gathering information, identifying different consumer groups and helping to make sure consumers are satisfied with products and services they are paying for.

Consumer understanding

The FCA Consumer Duty rules are clear that consumers need to understand what they are paying for and how it impacts their financial situation.

Firms need to ensure that customers have the information they need, presented in a clear and understandable way, to make informed decisions.

In practice, that might mean using simple language in product descriptions, or providing content in more than one language. It might mean having terms and conditions, including cancellation rights and how to make a complaint, clearly laid out on the company website.

Some companies will need to create new communication strategies, taking into account those who may find traditional channels difficult to access. Communications should be tested for clarity and ease of understanding. A tailored communications approach may be necessary for more complex products.

In some cases, it may be advisable to put metrics in place for measuring consumer understanding. One such might be whether customers take an expected action after being contacted with relevant information.

Clearly, contact centres have a large role to play here. Consumers often contact financial sector firms because they want clarity on a particular product or service. Contact centre leaders might consider writing new scripts, specifically with the aim of aiding greater consumer understanding in mind.

Consumer support

Consumer support typically happens through the contact centre, which needs to make sure agents interact with customers efficiently and with clarity. To that end, firms might work to reduce call waiting times, and put call monitoring in place so they can analyse the quality of agent/customer interactions.

Customer journeys may need to be improved, and customers should be offered communication channels of their choice. Omnichannel support – email, text, chat, as well as voice call – is likely to create better customer outcomes.

Again, meeting Consumer Duty requirements is likely to involve tailoring support journeys for vulnerable customers and more complex cases.

Measuring the success of new support strategies will be essential, including monitoring contact centre metrics like first contact resolution rates and call waiting times. Companies should also monitor the complaints they receive, looking for trends or patterns that suggest systemic issues.

How your contact centre needs to adapt

Enhancing customer journeys and outcomes

- Empathy and customer-centricity

Contact centre teams need to be aware of Treating Customers Fairly (TCF) principles and apply them whenever relevant. Agents should also be trained to identify vulnerable customers and provide appropriate support.

It’s important that agents prioritise empathy and active listening so they can properly understand customer needs. Training should focus on effective communication techniques to improve consumer understanding.

- Transparency and clear information

Contact centre teams should always provide clear and accurate information using plain language and avoiding jargon. This should include transparency around pricing, fees and any risks associated with a product or service. Make sure your scripts reflect these requirements. Be prepared to edit and update scripting whenever products or advice changes or in response to customer feedback.

Improving complaints handling

Consumer Duty requires firms to have effective complaints-handling procedures in place.

1. Handle complaints better:

- Establish efficient and effective complaints handling procedures.

- Train agents to handle complaints promptly, with empathy, and in line with regulations.

2. Learn from complaints:

- Analyse complaints to identify recurring issues and take proactive steps to address them.

- Promote a culture of continuous improvement by sharing insights from complaints across the organisation.

- Think about using speech analytics to monitor customer interactions and identify areas for improvement.

Monitoring and quality assurance

Create robust monitoring processes

You will only know that your contact centre is complying with new FCA Consumer Duty rules by putting robust monitoring systems in place.

That means measuring call centre performance and analysing complaints. It also involves regular agent reviews, audits of customer interactions and performance reviews.

Training and development

Your agent training and development programmes should highlight the FCA Consumer Duty rules, continually reinforce key messages and update agent knowledge as the rules and practice evolve.

A cultural shift

Firms can’t adapt to the new FCA Consumer Duty rules in an ad hoc or piecemeal way. To remain compliant, many financial service sector companies will have to undergo a cultural shift. From top to bottom, everyone in the organisation must understand and prioritise a new focus on customer protection and positive outcomes.

Fundamentally, the new FCA rules are about providing exceptional customer service. Consumers should have clear information about the products and services they want to buy. They should have all the support they need to make sure those products and services achieve expected outcomes. And when there are problems, companies need to take any complaints seriously and find solutions swiftly.

The FCA hopes and expects that its new Consumer Duty will benefit consumers, and also the industry as a whole. As Sheldon Mills said: “If applied correctly, the Duty should help firms retain and attract customers and will enhance the competitiveness of our financial services sector.”

More information

If you need more guidance on the Consumer Duty and what it means for you, there are lots of resources on the FCA website.

An overview of key publications.

Consumer Duty implementation plans.

The Consumer Duty policy statement.